Take control of your finances with the CalcGami EMI Calculator. Instantly estimate your monthly loan payments, view total interest costs, and compare loan offers to find the perfect repayment plan for your budget

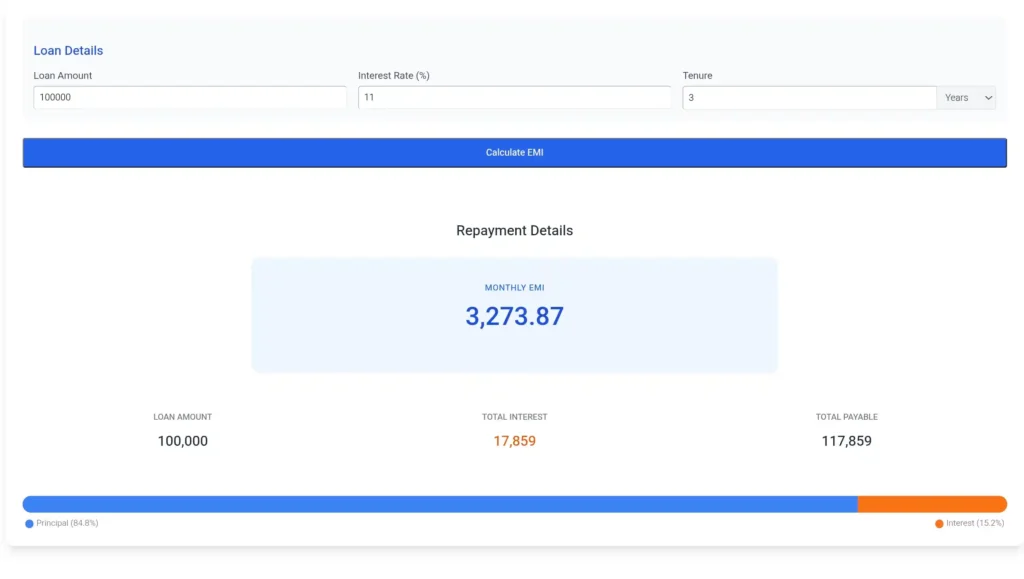

Repayment Details

Monthly EMI

0

Loan Amount

0

Total Interest

0

Total Payable

0

Table of Contents

What is an EMI Calculator?

An EMI Calculator is a financial utility designed to calculate the Equated Monthly Installment payable on a loan. Whether you are taking out a home loan, car loan, or personal loan, the EMI is the fixed amount of money you must pay to your bank or lender on a specific date each calendar month.

The EMI payment is not just a random figure; it is a carefully calculated blend of the Principal (the amount you borrowed) and the Interest (the cost of borrowing that money). In the early years of a long-term loan, a large portion of your EMI goes toward paying off the interest, while in the later years, the majority goes toward the principal. Calculating this manually is extremely difficult due to the compounding nature of interest. An EMI Calculator automates this complex math, giving you an instant, accurate figure so you can plan your monthly budget with confidence.

Benefits of Using an EMI Calculator

Before you sign on the dotted line for any loan, using an EMI calculator provides critical financial insights:

- Financial Planning: It helps you determine exactly how much money will leave your bank account every month, ensuring you don’t commit to a loan that exceeds your disposable income.

- Interest Transparency: Banks often highlight the monthly payment but hide the total cost. This tool reveals the Total Interest Payable, often showing that you might end up paying double the loan amount over a long tenure.

- Tenure Optimization: You can experiment with different timeframes. Seeing the difference between a 15-year and a 20-year mortgage helps you decide if a higher monthly payment is worth the massive interest savings.

- Loan Comparison: It allows you to quickly compare offers from different banks. A difference of just 0.5% in interest rates can save you thousands over the life of a loan.

- Prepayment Analysis: By understanding your breakdown, you can see how making small extra payments (prepayments) can drastically reduce your loan tenure.

Formula Used in EMI Calculator

The calculator uses the standard formula for reducing balance method, which is the method used by almost all banks and financial institutions globally.

The Formula:

EMI = [P x R x (1+R)^N] / [(1+R)^N-1]

The Variables:

- P (Principal): The original loan amount.

- R (Monthly Interest Rate): The annual interest rate divided by 12 months and then by 100.

- Example: If the rate is 12% per year, R = 12 / (12 x 100) = 0.01.

- N (Loan Tenure): The total number of months you have to repay the loan.

- Example: A 5-year loan is 5 x 12 = 60 months.

The Logic:

The formula calculates a constant periodic payment that will pay off the loan in full by the end of the term, assuming the interest rate remains constant.

How to Use the EMI Calculator

Follow these steps to generate your repayment schedule:

- Enter Loan Amount: Input the total amount you wish to borrow. (Do not subtract your down payment here; enter the actual debt amount).

- Enter Interest Rate: Input the annual interest rate offered by the bank (e.g., 8.5%).

- Enter Tenure: Input the duration of the loan. Ensure you select the correct unit (Years or Months).

- Calculate: Click the button to process the numbers.

- Analyze the Breakdown:

- Monthly EMI: The amount you pay every month.

- Total Interest: The extra money you pay the bank over the full term.

- Total Amount Payable: The sum of Principal + Interest.

Real-Life Example

Scenario: You are planning to buy a new car and need to take a loan of 20,000. The bank has offered you an interest rate of 9% per annum for a period of 5 years.

The Details:

- Principal (P): 20,000

- Annual Rate: 9%

- Tenure: 5 Years (60 Months)

The Calculation:

Step 1: Calculate Monthly Rate (R)

9% divided by 12 months = 0.75% per month.

In decimal form: 0.0075.

Step 2: Determine Months (N)

5 years x 12 months = 60 months.

Step 3: Apply the Formula

Numerator: 20,000 x 0.0075 x (1.0075)^60

Denominator: (1.0075)^60 – 1

- (1.0075)^60 is approx 1.5657

- Numerator: 20,000 x 0.0075 x 1.5657 = 234.855

- Denominator: 1.5657 – 1 = 0.5657

Step 4: Final Division

EMI = 234.855 / 0.5657 = 415.16

The Result:

Your monthly payment will be 415.16.

- Total Payment: 415.16 x 60 months = 24,909.60

- Total Interest: 24,909.60 – 20,000 = 4,909.60

Takeaway: Borrowing 20,000 will cost you nearly 5,000 in interest over 5 years.

Frequently Asked Questions (FAQ)

What happens if I choose a longer tenure?

Choosing a longer tenure (e.g., 25 years instead of 20) decreases your monthly EMI amount, making it easier on your monthly pocket. However, it significantly increases the Total Interest Payable. You will end up paying much more to the bank in the long run.

Does this calculator work for both Home and Car loans?

Yes. The mathematical formula for a standard reducing balance loan is the same regardless of whether the asset is a house, a car, or a personal expense. However, ensure you enter the correct interest rate, as personal loans usually have much higher rates than home loans.

What is the difference between Fixed and Floating interest rates?

Fixed Rate: Your EMI remains exactly the same for the entire loan duration.

Floating Rate: The interest rate changes based on market conditions (repo rate). If rates go up, your lender may increase your EMI amount or extend your loan tenure. This calculator assumes a constant rate for the calculation.

Does the EMI amount include prepayment charges or processing fees?

No. This calculator computes the pure loan installment (Principal + Interest). It does not account for one-time processing fees, insurance premiums bundled with the loan, or penalties.

How much of my income should go towards EMI?

Financial experts generally recommend the “40% Rule.” Your total EMIs (including car, home, and credit cards) should not exceed 40% of your net monthly income. If your EMIs are higher than this, you may face financial stress during emergencies.

Why is the interest portion so high in the beginning?

This is how amortization works. In the first month, your outstanding loan balance is at its highest, so the interest calculated on that balance is also high. As you pay down the principal month by month, the interest portion shrinks, and the principal portion of your EMI increases.

Add this calculator to your website: