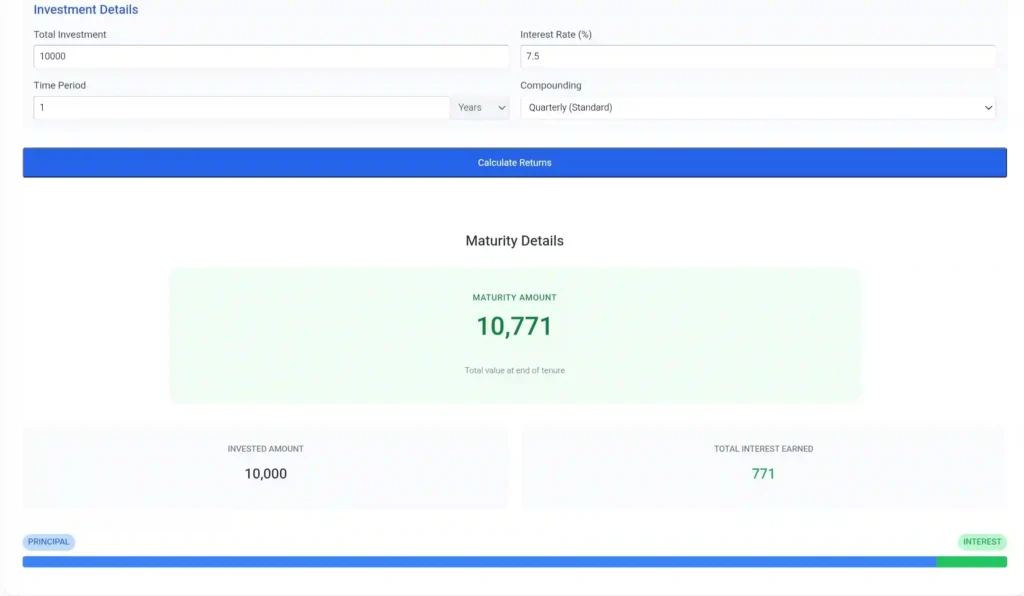

Maximize your investment returns and secure your financial future with the CalcGami FD Calculator. Instantly calculate maturity amounts, visualize the power of quarterly compounding, and compare interest rates to ensure your Fixed Deposits are working as hard as possible for your wealth.

Maturity Details

Maturity Amount

0

Total value at end of tenure

Invested Amount

0

Total Interest Earned

0

Table of Contents

What is an FD Calculator?

An FD Calculator (Fixed Deposit Calculator) is a comprehensive financial planning tool designed to help investors and savers accurately predict the future value of their capital when placed in a Fixed Deposit account.

In the world of personal finance, a Fixed Deposit (FD) is widely regarded as one of the safest and most reliable investment vehicles. It involves depositing a lump sum of money with a bank or non-banking financial company (NBFC) for a specific period, ranging from as short as 7 days to as long as 10 years. In return, the institution guarantees a fixed interest rate that is typically higher than a regular savings account.

However, calculating the returns on an FD is not as straightforward as simple multiplication. Most modern Fixed Deposits utilize the power of Compound Interest, meaning the interest you earn in the first quarter is added to your principal, and in the next quarter, you earn interest on that new, larger total. This “interest on interest” effect accelerates your earnings over time. The FD Calculator automates this complex mathematical process, taking into account the principal, tenure, interest rate, and compounding frequency to give you a precise “Maturity Amount”—the exact check you will write to yourself when the term ends.

Benefits of Using an FD Calculator

While FDs are simple products, the math behind them can be tricky. Using a specialized calculator offers several strategic advantages for your portfolio:

- Precision with Compound Interest: Manual calculations often overlook the compounding frequency (e.g., quarterly vs. yearly). This calculator handles the exponential math to show you the true yield of your investment, which is often higher than the nominal interest rate.

- Goal-Based Financial Planning: By working backward, you can determine your current needs. For example, if you know you need exactly 500,000 for a wedding in 5 years, the calculator helps you find exactly how much you need to deposit today to hit that target.

- Apples-to-Apples Comparison: Banks compete for your money by offering different rates. A difference of just 0.25% might seem small, but over 5 or 10 years, it can result in a significant difference in payout. This tool allows you to compare different bank offers side-by-side.

- Inflation Analysis: By seeing the total interest earned, you can assess whether your money is truly growing or just keeping pace with inflation. This helps you decide if you need to lock in money for a longer term to get a better rate.

- Income Stream Management: For retirees or those choosing “Non-Cumulative” FDs (where interest is paid out rather than reinvested), this tool calculates the exact monthly or quarterly income you can expect to support your living expenses.

Formula Used in FD Calculator

The calculator uses the standard Compound Interest Formula used by banks worldwide. While simple interest formulas are linear, this formula is exponential, reflecting how wealth accelerates over time.

The Formula:

A = P x (1 + r/n)^(n x t)

The Variables Explained:

- A (Maturity Amount): The final accumulated value of the investment (Principal + Total Interest).

- P (Principal): The initial lump sum amount you deposit.

- r (Rate of Interest): The annual nominal interest rate. (Note: In the formula, this is converted to a decimal. For example, 7.5% becomes 0.075).

- n (Compounding Frequency): This represents how many times per year the bank calculates and adds interest to your account.

- Quarterly (n=4): The most common standard for banks.

- Monthly (n=12): Often used for corporate deposits.

- Half-Yearly (n=2): Used by some government bonds.

- Yearly (n=1): The simplest form.

- t (Tenure): The total time period the money is invested for, expressed in years.

The Logic:

The formula divides the annual rate by the number of periods to find the “periodic rate.” It then multiplies the total number of periods (years x frequency) to determine how many times that periodic rate is applied to the growing balance.

How to Use the FD Calculator

Follow these detailed steps to generate an accurate forecast of your savings:

- Enter Investment Amount: Input the total lump sum you plan to lock away. (e.g., 100,000). Ensure this is money you do not need for immediate daily expenses.

- Enter Interest Rate: Input the annual interest rate offered by your chosen bank. Check the bank’s website for the most current rates, as they change frequently based on central bank policies.

- Select Tenure: Choose the duration of the deposit. You can usually enter this in Years, Months, or Days.

- Tip: often, banks offer “special tenures” (like 444 days or 18 months) that carry higher interest rates than standard 1-year terms.

- Select Compounding Frequency: Choose “Quarterly” if you are unsure, as this is the default for most commercial banks. Only change this if you know your specific product compounds differently.

- Calculate: Click the button to process the exponential math.

- Analyze the Results:

- Maturity Amount: The total cash value at the end of the term.

- Total Interest: The pure profit generated by your capital.

Real-Life Example

Scenario: “David” has received a year-end bonus of 100,000. He wants to save this money for a down payment on a car in 5 years. He finds a bank offering a competitive interest rate of 7.5% per annum, compounded quarterly.

The Details:

- Principal (P): 100,000

- Rate (r): 7.5% (0.075)

- Tenure (t): 5 Years

- Frequency (n): 4 (Quarterly)

The Calculation:

Step 1: Determine the Periodic Rate

Divide the annual rate by the frequency.

0.075 / 4 = 0.01875 (This is the interest earned every 3 months).

Step 2: Determine Total Compounding Cycles

Multiply the years by the frequency.

5 years x 4 quarters/year = 20 cycles.

Step 3: Apply the Compound Factor

Add 1 to the periodic rate and raise it to the power of the cycles.

(1 + 0.01875)^20

(1.01875)^20 = 1.4499 (approx).

Step 4: Calculate Final Value

Multiply the Principal by the Compound Factor.

100,000 x 1.4499 = 144,990.

The Result:

- Maturity Amount: 144,990

- Total Interest Earned: 44,990

- Takeaway: By locking his money away, David earned nearly 45% profit on his initial capital without taking any stock market risks. If this had been simple interest, he would have only earned 37,500. The compounding added an extra 7,490 to his wealth.

Frequently Asked Questions (FAQ)

What is the difference between Cumulative and Non-Cumulative FD?

This choice determines when you get your interest.

Cumulative FD (Reinvestment Plan): The interest you earn is re-invested back into the principal. You do not receive a single penny until the FD matures. This option maximizes the power of compounding and is ideal for wealth creation.

Non-Cumulative FD (Payout Plan): The interest is paid out to your savings account at regular intervals (monthly, quarterly, or yearly). This does not benefit fully from compounding, but it is excellent for retirees who need a steady stream of income to pay bills.

How does the “laddering” strategy work with FDs?

FD Laddering is a smart strategy to manage liquidity. Instead of putting all your money into one big 5-year FD, you split it into five parts: a 1-year FD, a 2-year FD, a 3-year FD, etc. When the 1-year FD matures, you reinvest it for 5 years. This way, one of your FDs matures every single year, giving you access to cash if needed, while still averaging out the long-term interest rates.

Is my money safe in a Fixed Deposit?

Yes, FDs are considered one of the safest asset classes. In many countries, bank deposits are insured by government bodies (like the DICGC in India or FDIC in the USA) up to a certain limit. Even if the bank fails, your principal and interest up to that limit are protected by sovereign guarantee.

Can I withdraw my FD before the maturity date?

Yes, FDs offer liquidity, but it comes at a cost. If you need the money before the term ends, you can do a “Premature Withdrawal.” However, the bank will typically deduct a penalty (usually 0.5% to 1%) from the interest rate applicable for the period the money was actually with the bank. It is best to keep an emergency fund separate so you don’t have to break your FDs.

How is FD interest taxed?

It is a common myth that FD interest is tax-free. In most jurisdictions, interest earned on FDs is fully taxable. It is added to your total annual income and taxed according to your income tax slab. If the interest exceeds a certain threshold, the bank may deduct Tax Deducted at Source (TDS) before paying you. You should factor this tax liability into your net return calculations.

What is the difference between an FD and a Recurring Deposit (RD)?

Fixed Deposit (FD): You deposit a large lump sum amount once at the beginning of the term.

Recurring Deposit (RD): You do not need a lump sum. You deposit a small fixed amount every month for the duration of the tenure.

Use an FD Calculator if you have a lump sum today. Use an RD Calculator if you plan to save monthly from your salary