Plan your dream bike purchase with the CalcGami.com Motorcycle Loan Calculator. Instantly estimate your monthly payments (EMI), compare interest rates, and determine the ideal down payment to fit your budget.

Payment Breakdown

Monthly Payment

0

Estimated EMI

Total Interest

0

Cost of Loan

Total Payable

0

Principal + Interest

Table of Contents

What is a Motorcycle Loan Calculator?

A Motorcycle Loan Calculator is a financial planning tool designed to help prospective bike buyers estimate their monthly loan payments (often called EMIs or Equated Monthly Installments). Before walking into a dealership, it is essential to understand not just the sticker price of the motorcycle, but the long-term cost of financing it. Financing a motorcycle involves several variables: the loan amount, the interest rate charged by the lender, and the repayment tenure. This calculator processes these variables to give you a clear picture of your financial commitment. It helps you distinguish between what you can buy and what you can actually afford to pay on a monthly basis without straining your finances.

Benefits of Using a Motorcycle Loan Calculator

Using a specialized motorcycle loan calculator before signing any paperwork offers several financial advantages:

- Budget Clarity: It instantly calculates exactly how much you need to set aside from your monthly income, helping you avoid payment defaults.

- Total Cost Awareness: While low monthly payments look attractive, they often mean paying more interest over a longer time. This tool reveals the total interest payable over the life of the loan.

- Down Payment Planning: You can experiment with different down payment amounts to see how paying more upfront drastically reduces your monthly burden and total interest.

- Dealership Negotiation: Entering a dealership knowing your numbers prevents you from being swayed by confusing financing jargon or “low monthly payment” sales pitches that hide high interest rates.

- Comparison Shopping: It allows you to quickly compare offers from different banks or lenders to see which one offers the most affordable repayment structure.

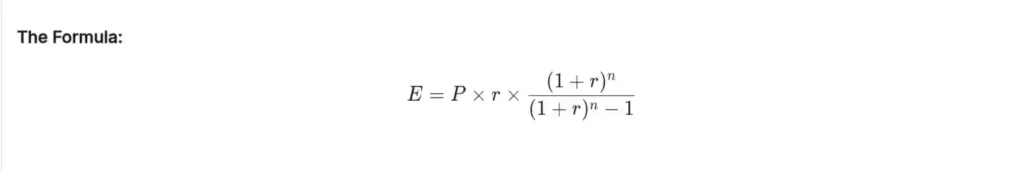

Formula Used in Motorcycle Loan Calculator

The motorcycle loan calculator uses the standard Amortization Formula to determine your monthly payment. This formula balances the principal amount and the interest over the loan term.

Where:

- E = EMI (Equated Monthly Installment)

- P = Principal Loan Amount (The price of the bike minus your down payment)

- r = Monthly Interest Rate (Annual interest rate divided by 12 months)

- n = Loan Tenure in months

Logic:

The formula ensures that in the early months of your loan, a larger portion of your payment goes toward interest, while in the later months, a larger portion goes toward paying off the principal balance.

How to Use the Motorcycle Loan Calculator

Follow these simple steps to calculate your payments:

- Enter Vehicle Price: Input the total on-road price of the motorcycle you wish to buy.

- Enter Down Payment: Input the amount of cash you intend to pay upfront. The calculator will subtract this from the vehicle price to determine the “Loan Amount.”

- Input Interest Rate: Enter the annual interest rate offered by your bank or lender (e.g., 9%).

- Select Loan Term: Choose how long you want to take to pay off the loan (usually between 1 to 5 years).

- Calculate: Click the button to generate your results. You will see your estimated monthly payment and the total interest you will pay over the full term.

Real-Life Example

Scenario: You have your eyes on a high-performance cruiser bike priced at 125,000. You have saved 25,000 for a down payment and need to finance the remaining 100,000 through a bank loan.

The Details:

- Loan Amount (Principal): 100,000

- Interest Rate: 8% per annum

- Loan Tenure: 3 Years (36 Months)

The Calculation:

- Monthly Rate (r): 8% ÷ 12 = 0.666% (or 0.00666)

- Number of Months (n): 36

- Application: The calculator applies the amortization formula to these figures.

The Results:

- Monthly Payment (EMI): Approx 3,134

- Total Interest Payable: Approx 12,811

- Total Cost of Loan: 112,811

Takeaway: By using the motorcycle loan calculator, you can see that borrowing 100,000 will cost you a total of 112,811 over three years. This means you must ensure your monthly budget can accommodate the 3,134 payment comfortably.

Frequently Asked Questions (FAQ)

What is a “Down Payment” and how does it affect my loan?

A down payment is the portion of the bike’s price that you pay in cash upfront. The higher your down payment, the lower your loan amount. This results in lower monthly payments and less interest paid over the life of the loan.

Does a shorter loan term save me money?

Yes. A shorter loan term (e.g., 24 months vs. 60 months) increases your monthly payment but significantly decreases the total interest you pay. A longer term lowers your monthly payment but increases the total cost of the bike due to accumulated interest.

Does this calculator include insurance and taxes?

This motorcycle loan calculator estimates the loan repayment based on the principal amount you enter. If you want to include insurance, registration fees, and taxes, you must add those costs to the “Vehicle Price” field before calculating.

Why is my actual bank quote slightly different from the calculator result?

Online calculators provide estimates based on pure mathematical formulas. Banks may add processing fees, administrative charges, or use slightly different compounding intervals. Always treat the calculator result as a close estimate rather than a final binding quote.

How does my credit score impact the calculator results?

The calculator itself does not check your credit score. However, in the real world, a higher credit score qualifies you for a lower interest rate. If you have excellent credit, enter a lower interest rate (e.g., 6-8%) into the calculator. If you have poor credit, enter a higher rate (e.g., 12-15%) for a realistic estimate.

Can I pay off my motorcycle loan early?

Most lenders allow early repayment, but some may charge a “prepayment penalty.” If you plan to pay off the loan faster than the schedule, ask your lender about their specific terms regarding early closure.